GST Rule : In a surprising move that has sparked nationwide debate, reports suggest that digital payments made via UPI (Unified Payments Interface) over ₹2,000 could now attract GST charges under certain conditions. With UPI being the backbone of India’s digital economy, any taxation on such transactions is bound to impact millions. Here’s everything you need to know about the latest development, who it affects, and what changes you should be prepared for.

What Is the New GST Rule on UPI Transactions?

The GST Council and the Finance Ministry are reportedly considering implementing Goods and Services Tax (GST) on certain UPI transactions exceeding ₹2,000. However, this does not mean every payment you make over ₹2,000 will be taxed. The move is likely to target commercial or merchant-based transactions and not peer-to-peer (P2P) payments.

Key Highlights:

- GST likely to be applicable on merchant UPI transactions above ₹2,000.

- Peer-to-peer (P2P) personal transactions are expected to remain tax-free.

- The tax burden may be passed on to the end customer in the form of price hikes.

- Implementation still under policy review by the GST Council and RBI.

Why Is GST Being Considered on UPI Transactions?

The main reason behind this potential policy change is revenue generation. As India transitions into a cashless economy, a significant volume of transactions is moving to digital platforms, especially UPI. Unlike debit/credit card transactions, many UPI-based merchant transactions currently do not attract GST or MDR (Merchant Discount Rate), leading to revenue leakage.

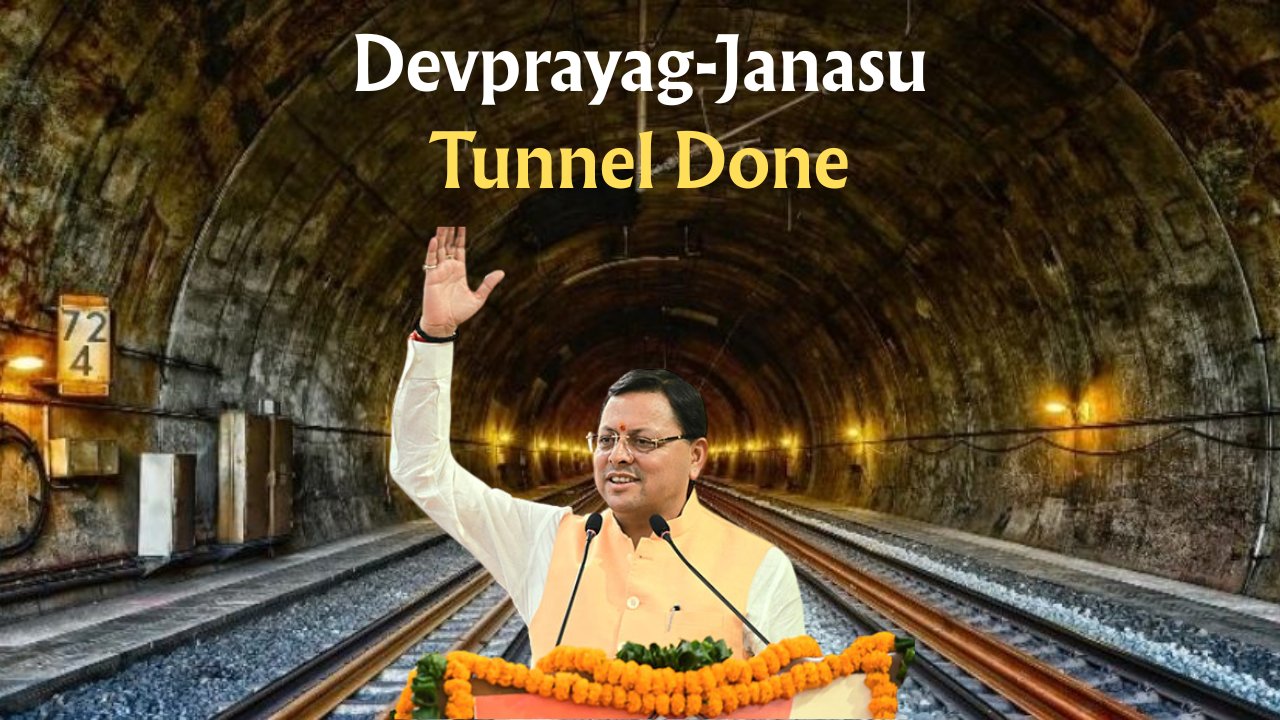

India’s Longest Devprayag-Janasu Railway Tunnel Completed in Uttarakhand – Know Route and Benefits

India’s Longest Devprayag-Janasu Railway Tunnel Completed in Uttarakhand – Know Route and Benefits

Factors Behind the Move:

- Increased usage of UPI by businesses for large-scale transactions.

- Need to bring parity in taxation between digital payment modes.

- Efforts to formalize unreported commercial activities.

Who Will Be Impacted by This Rule?

The proposed GST rule would primarily affect merchants, small business owners, and digital service providers who accept payments via UPI. Customers may also feel the heat if businesses decide to pass the tax component to them.

Affected Parties:

- Shopkeepers and merchants using UPI QR codes.

- Online sellers and freelancers accepting payments through UPI apps.

- Consumers making high-value purchases from merchants.

See more : Widow Pension Scheme 2025 Announced

Exemptions: Who Is Not Affected?

It’s important to note that personal payments, such as sending money to friends or family, utility bill payments, and bank-to-bank transfers for non-commercial purposes are unlikely to attract any GST.

Transactions Likely to Be Exempt:

- Sending money to friends or relatives via UPI.

- Payments for domestic needs like rent or tiffin services (non-commercial).

- P2P transfers below or above ₹2,000, if not tied to business transactions.

GST Slab and Calculation for UPI Transactions

While the final implementation details are awaited, here’s how GST may be applied if the rule comes into force. The tax could fall under existing slabs such as 5%, 12%, or 18%, depending on the nature of the goods or services sold via UPI.

Sample GST Calculation Table for UPI Merchant Transactions:

| Transaction Amount | GST Slab (Assumed) | GST Amount | Total Payable |

|---|---|---|---|

| ₹2,001 | 5% | ₹95.29 | ₹2,096.29 |

| ₹3,000 | 12% | ₹321.43 | ₹3,321.43 |

| ₹5,000 | 18% | ₹762.71 | ₹5,762.71 |

| ₹7,500 | 12% | ₹803.57 | ₹8,303.57 |

| ₹10,000 | 18% | ₹1,525.42 | ₹11,525.42 |

| ₹15,000 | 5% | ₹714.28 | ₹15,714.28 |

| ₹20,000 | 18% | ₹3,050.84 | ₹23,050.84 |

Public Reaction and Concerns

The possible move has drawn mixed reactions. While experts believe it could help streamline taxation on digital commerce, critics argue it may discourage UPI adoption and hurt small vendors.

Common Concerns:

- Small traders may shift back to cash to avoid taxation.

- Increased cost burden on consumers.

- Risk of confusion between personal vs commercial UPI use.

What Are Authorities Saying?

As of now, there is no official notification confirming the imposition of GST on UPI payments above ₹2,000. However, sources indicate the GST Council may deliberate on the matter in upcoming meetings. RBI and NPCI (National Payments Corporation of India) are also expected to issue clarifications.

Current Status:

- Under review by the GST Council.

- No official implementation date.

- Final policy may include multiple exemptions.

Tips for Users and Merchants

To avoid future hassles, users and merchants should start categorizing their UPI transactions more clearly. If you are a business owner, consider getting a separate UPI ID for commercial activities.

Recommendations:

- Maintain separate UPI IDs for business and personal use.

- Keep invoices or receipts for high-value digital transactions.

- Stay updated with GST Council announcements.

The possibility of GST being levied on UPI payments over ₹2,000, especially for merchant transactions, marks a significant shift in India’s digital payment ecosystem. While personal users may remain unaffected, merchants and small businesses should prepare for compliance if this rule is implemented. As always, it’s essential to await official notifications and avoid panic based on preliminary reports.

Stay informed. Stay compliant.